Zoomark International 2021 Insights

From 10 to 12 November 2021, Bologna, Italy, was at the center of the European pet care industry. This edition of Zoomark was spread around 4 large exhibition halls, where around 450 exhibitors showed their innovations in pet products. Overall, it was good to see that the pet industry is still going strong, both in Europe and the rest of the world.

Let's dive into the trends and innovations we spotted at the Zoomark International 2021 fair.

Zoomark International 2021 Pre-Considerations: Navigating the Pet Spending Surge

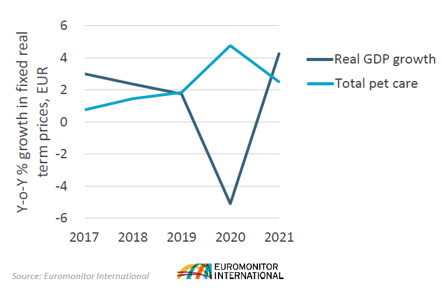

From the start of the COVID-19 pandemic, there has been a large increase in pet spending. From early 2020, many people bought a ‘corona pet’ to keep them company during lockdowns. Since then, all sub-industries in the pet care market have seen a surge in revenue.

Although 2021 did not show the same extreme numbers, the growth is still positive. The pet care market has shown that it’s a stable, continuously growing market despite recessions and pandemics happening in the world.

What We Learned from Zoomark International Fair 2021

The show was generally in line with previous editions. To be very honest, we did not see groundbreaking innovations that would shake up the pet care market completely. Covering all themes is the trend of pet humanization, treating your pet as if it’s a human being and a true part of the family.

“The emergence of pet parents as part of the humanization of pets trend, is a key revenue generating trend in the pet industry.”

Businesswire

Some central themes:

Luxury, premium pet products are in demand

There was more attention to luxury and comfort, probably because consumers got to spend more time together with their beloved pets in the last years and see them as part of the family. The mid-priced segment made way for the premium segment.

Pet food is following people's food trends

Better, healthier pet food is on the rise, following the human food trends we saw at Anuga. At Zoomark International 2021, we also saw less economy and mid-priced products and more premiums, for example, dry and wet food enriched with vitamins and minerals or even vegan dog food.

The pet food market is still dominated by the largest players, Mars and Nestlé. They keep adding new products to their assortments every year.

Pet owners are focused on sustainability

Research from Euromonitor shows that pet owners are more focused on sustainability than non-pet owners. This goes for all income groups and all age groups. It’s not certain if consumer demand is the driver behind the big food players’ sustainability initiatives or if it is the pressure from governmental rules and regulations.

Both Mars and Nestlé have set goals for sourcing, emission, and recycling.

Pet-motic is the hottest new kid in town

Nice to see were the innovations in smart accessories, like smart collars, tracking devices, automatic feeders, automatic fetch toys, etc. All sorts of technology and electronics serve pets and pet parents. Even a blanket with a simulated heartbeat helps little Pookie not feel so lonely when home alone.

Taking care of our pets’ health

Following the trends of pet humanization and premiums, consumers are spending more money than ever on their pets’ health. Products like over-the-counter medicine and food supplements for shiny fur, supple joints, or fresh breath.

Also interesting to see is the growing interest in products that help old or disadvantaged pets live happy lives. A nice example is Handicapped Pets, a EuroDev client that provides dog wheelchairs.

From Zoomark International to Selling in Europe

Zoomark International is a great platform to meet with like-minded stakeholders, including distributors, manufacturers, associations, and regulatory bodies. Hence, attending a fair like this one brings a lot of opportunities for North American pet product suppliers to expand into the European market.

Sustainable products

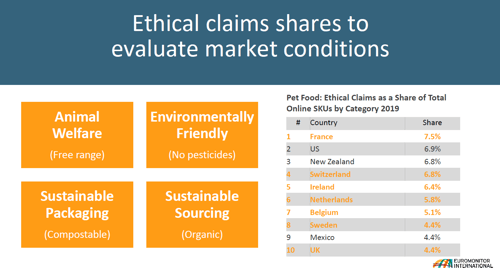

The top 10 countries that have the highest percentage of ethical claims on pet food products consist of 7 European countries. The US, New Zealand, and Mexico complete the top 10. The most important growth markets are products that are good for animal welfare, environmentally friendly, and sustainably sourced and packaged.

So, if you are a North American manufacturer of sustainable or ecological pet products, there are many opportunities for growth waiting for you in countries like France, Switzerland, Ireland, and the Benelux.

Private label

Most US companies want to see their brand name on the shelves, but in the EU, some large retail players are expanding their private label products. The growth of private labels outperforms branded products in Europe, according to Euromonitor International. So, if you are willing to make some changes, the demand for your products can be high.

Smart accessories

American manufacturers are better at creating smart accessories than European companies. They are just a bit more at the forefront of technological innovations in the pet industry. Products that are currently in high demand in North America will follow in Europe within the next few years.

Where we step in

If you are a North American supplier of pet products and curious about how to enter or expand into the European pet market, EuroDev is here to help. For more than 25 years, we have helped manufacturers and suppliers from the USA and Canada with their international business expansion.

We have experience in the pet care industry in Europe and can help you with market research, sales strategy, lead generation, digital marketing, and getting into new business. Check out our Sales Outsourcing solutions for your European business expansion.

We're looking forward to meeting you at the Zoomark International 2022 fair!

Category

Related articles

-

Beauty & Personal Care Market: Insights into Europe's Thriving Market

28 December 2023Discover the latest insights and trends in the flourishing beauty & personal care market in Europe.

Read more -

Navigating REACH Regulations for Safety & Innovation

7 December 2023Discover how the REACH regulations play a crucial role in ensuring the safety and the importance of...

Read more -

Unlocking the European Market: Finding Cleaning Products Distributors

25 October 2023Unlock Expert Insights for Cleaning Product Distributors – Tips & Knowledge Awaits!

Read more