Cost of Hiring an Employee in EU: A Comprehensive Guide

What are the costs of hiring an employee in Europe? The European employment costs differ per country due to the differences in social contributions and benefits. The true employment costs contain more than just the gross salary, and for some North American businesses, the associated employment costs are a decisive factor in choosing where to hire an employee.

In this blog, we will compare the costs of hiring an employee across 10 popular European countries.

Average Salaries in Europe

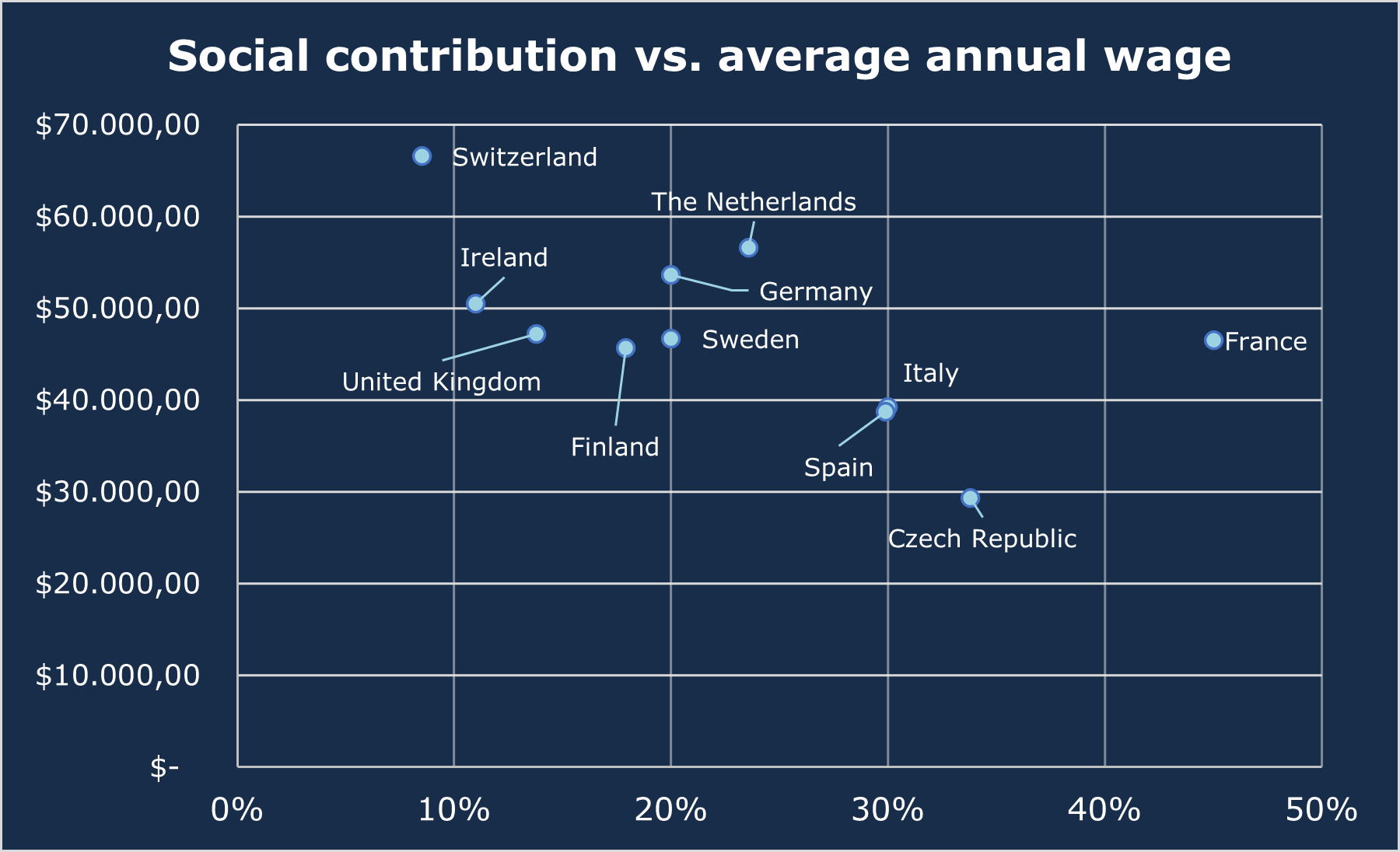

On average, salaries are higher in Western and Northern European countries. Switzerland, Denmark, and the Netherlands are considered to have high salaries. In Eastern and Southern Europe, you can generally find lower salaries in countries such as Italy, Spain, and the Czech Republic.

Despite the variation in what salary rate is common for a certain position across the different countries, the comparison below takes a gross annual salary of EUR 80,000.00 as a base. It is assumed that irregularities such as 13th-month salary (Italy, Switzerland), 14th-month salary (Italy), and holiday allowance (the Netherlands, 8%) are included in this gross base salary.

It is common to agree upon a set gross annual salary with the client and calculate how that translates to irregularities such as a 13th salary month or an 8% holiday allowance. Employer's costs, such as the social contribution, will come on top of the annual gross base salary.

Bonus read: Average Salary in Europe: Insights and Trends

Costs of Hiring European Employees

In the table below, you can find a summarized overview of the total employer's cost per year. As is already mentioned, the comparison takes a gross annual salary of €80.000,00 as a base. In the calculation, costs such as social contributions, pension contributions, and other irregularities, as described in the paragraph above, are included as well.

At the end of this blog, you can find a detailed overview of the costs of employment in Germany.

| Country | Total annual employer's cost per year (€) | Total annual employer's cost per year ($) |

| 1. France | € 116,000 | $ 138,768 |

| 2. Italy | € 104,774 | $ 125,339 |

| 3. Czech Republic | € 101,588 | $ 121,527 |

| 4. Spain | € 99,097 | $ 118,547 |

| 5. Sweden | € 96,000 | $ 114,842 |

| 6. Germany | € 95,984 | $ 114,823 |

| 7. Finland | € 93,320 | $ 111,636 |

| 8. United Kingdom | € 92,037 | $ 110,102 |

| 9. The Netherlands | € 90,461 | $ 108,216 |

| 10. Ireland |

€ 88,800 |

$ 106,229 |

| 11. Switzerland |

€ 86,800 |

$ 103,837 |

Costs of an Employee Key Driver

As mentioned, the true employment costs contain more than just the gross salary. An employer has to think about costs related to employee recruitment, employee benefits, payrolls, taxes, insurance, retirement benefits, performance bonuses, specific perks considering the country's culture and the industry, and many more.

In summary, the following factors are the key drivers of European employment costs:

- Salary,

- Social contributions,

- Benefits.

Social security contributions

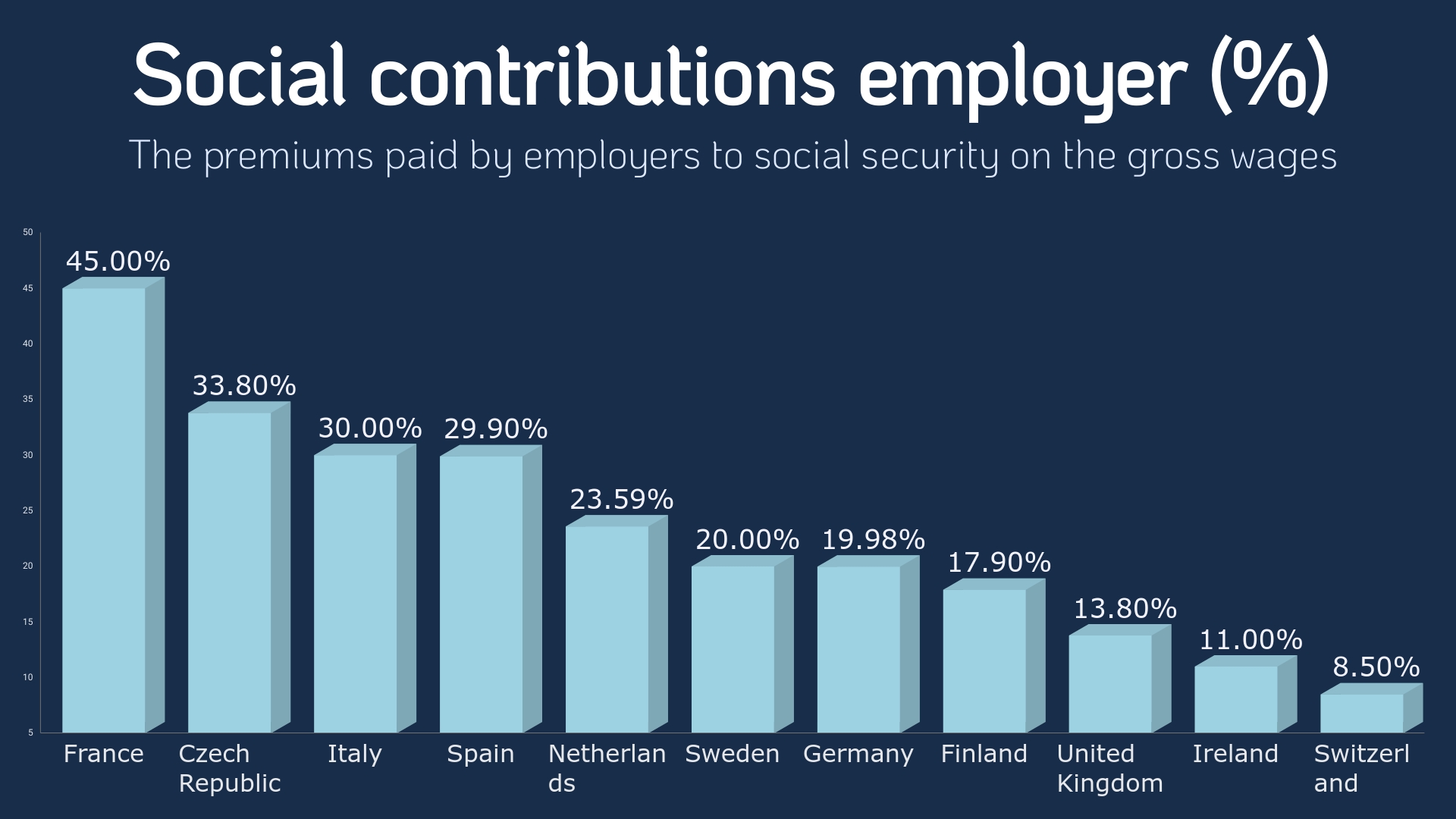

The cost of employment does not only concern salaries but also social security contributions. The high employment costs in France are mainly due to the high social contributions. France has the highest employer’s social security contributions, averaging 45%.

On the other hand, employers in Switzerland pay the lowest social contributions, around 8,5%. In some countries, like the Netherlands, these contributions are capped. This year, Dutch employers’ social contributions are capped at EUR 871,75.

Employee benefits

Insurance, retirement plans, and other benefits are also elements that employers need to take into account. In some countries, employers are obliged to provide certain benefits.

For example, in the UK, both employees and employers must contribute to a pension. The statutory contribution is 5% and 3%, respectively, reaching a total of 8%. Although not presented in the comparison, in Switzerland, it is also mandatory for employees and employers to contribute to a pension, and the average rate is 7%. Besides pensions, it is also obligatory for employers in Switzerland to provide insurance such as accident insurance and health/sickness insurance.

There are many options for employer/employee contribution rates that could be suited to the individual situation. In some countries, for example, Italy, employers accrue severance pay when the employee leaves the company (TFR). This reflects approximately 7% of the salary.

The cost that employers might come across is occupational accident insurance, which is mandatory in some countries like Germany and Italy. These are normally charged annually, and the amounts are not too high (depending on the specific sector).

Detailed Overview of Costs of Hiring an Employee in Europe

To give you a short overview of what a "detailed" overview can look like, a German example can be found below. Please note that this can differ per industry and collective labor agreement.

| Country | Germany (Mandatory) | Germany (Common) |

| Gross annual salary | € 110,000.00 | € 110,000.00 |

| Gross annual bonus | € 15,000.00 | € 15,000.00 |

| Gross salary per month | € 9,166.67 | € 9,166.67 |

| Gross salary per month inc. bonus | € 10,416.67 | € 10,416.67 |

| Benefits: | ||

| Car allowance | € 900.00 | |

| Phone allowance | € 40.00 | |

| Additional pension contribution | € 275.00 | |

| Paid leave | 20 days | 25-30 days |

| Social contribution in % (average) | 19,38% | 19,38% |

| Pension insurance (9.3%) | € 852.50 | € 852.50 |

| Unemployment insurance (1.25%) | € 114.58 | € 114.58 |

| Health insurance (7.3%) | € 669.17 | € 669.17 |

| Long-term insurance (1.525%) | € 139.79 | € 139.79 |

| Social contributions per month | € 1,776.04 | € 1,776.04 |

| Total gross salary per month | € 12,192.71 | € 13,407.71 |

| Total gross salary per year | € 146,312.50 | € 160,892.50 |

More information

Many companies are dealing with employee shortages by hiring internationally. But, dealing with different labor laws, policies, and costs of hiring an employee in the EU is everything but simple, and it requires a lot of experience.

However, with EuroDev HR Outsourcing services, you can hire in Europe fast without worrying about setting up an entity. You will stay compliant in every European country of your choice, and you will have an excellent team experience to offer the necessary HR support. Let’s chat about the next steps for your hiring in Europe.

Sources: OECD – Annual Wages

Category

Related articles

-

Essential Guide to French Employment Regulations

22 March 2024comprehensive guide on French employment regulations for companies expanding to France, covering...

Read more -

Germany's Pension Landscape: Navigating Benefits and Taxation for Informed Decision-Making

5 February 2024Dive into the intricacies of the German pension system: benefits, calculations, retirement options,...

Read more -

Decoding Statutory Sick Pay (SSP) in the UK

29 January 2024Navigate the complexities of Statutory Sick Pay in the UK with our guide on rights, regulations,...

Read more