Why UK-Based Medical Device Manufacturers Should Focus On European Expansion: 5 Reasons

If you haven’t considered expanding to Europe, or if you are interested to expand your current European footprint, now could be the time to consider a European sales strategy that could help you grow and secure your European market position in a low-risk and cost-effective manner.

This blog post will cover the developments that have a major impact on UK-based medical device manufacturers:

- European growth opportunities

- Brexit scenario’s

- NHS budget constraints

- Slowing down the Covid-19 pandemic and beyond

- MDR regulations

- Why sales outsourcing can offer an outcome

EuroDev is a leading business expansion provider offering a range of services to assist North American and UK manufacturers expand successfully in Europe. More on our sales development programs, services, and track record can be read at the end of the article.

5 reasons why you as a UK medical device manufacturer should consider expanding (further) into Europe

1: Europe offers a significant growth opportunity

With exporting 46% of goods, Europe is the largest and most important trading partner for the UK. With a growth trend from 33£ bln in 2015 Q1 to 40£ bln in 2017 Q1, facts show the stable demand of goods required and delivered from the UK. Europe remains to be the second largest economy in the world both in nominal terms and according to the purchasing power parity. With a population of 446 million people, it offers tremendous growth opportunities with the right approach and in the right markets.

.png?width=711&name=uk-blog_47227693%20(3).png)

2: Both Brexit scenarios re-emphasize the importance of European expansion

Both scenarios show strong reasons to pursue and expand into the European market. They show waiting for an outcome will increase the chance of falling behind European and Third country competitors resulting in missing out on the opportunities and being too late once Brexit has been finalized.

Scenario 1 (Free Trade Agreement)

Under the FTA, the UK and the EU would negotiate the terms of access for specific sectors, including the standards and regulations that apply in those sectors such as the CETA. This would reduce costs for the UK as well as for European companies exporting to the UK.

However, the EU wants the UK to comply with similar rules as EU-state members such as state aid, labor laws, environmental standards, and tax rules to make sure there is equal competition with EU members.

The best possible scenario would be an FTA, however, there are still many areas of disagreement and past experience shows that multilateral FTAs take between five to ten years to negotiate and may need to be ratified by national, and even regional, parliaments.

The impact of this scenario:

- Reasons to export to Europe with an FTA will remain evident and will offer more opportunities for UK companies as they will have an advantage over third countries.

- Due to insecurities such as the current developments you may want to diversify your customer base, increase your turnover to offset risks, and start with the establishment of a footprint in local regions to secure a sustainable market position in any scenario. Taking the opportunity to leverage free trade will always be favorable.

- The timing to expand now is more important as it will make you stay ahead of your UK competitors. They may be waiting for clarity and as it could take years to come to an agreement, not considering the annual growth possibilities can be a missed opportunity.

Scenario 2 (World Trade Organization rules)

A no-deal Brexit will fall back to World Trade Organization rules – the costs of trade between the UK and the EU will increase.

These costs can be broadly defined as market access measures (tariffs and quotas), increased administrative burden (including customs formalities and VAT), and behind-the-borders rules that define the extent of non-tariff barriers (NTBs) to trade.

As a result of the loss of competitiveness in a hard Brexit, EU demand for UK exports is projected to fall. In proportionate terms, the decline is most notable in the consumer goods and automotive sectors, mainly reflecting the higher rates of tariff and non-tariff barriers that would apply and least apply in the medical device industry.

The impact of this scenario:

- There is a strong likelihood the UK government will loosen certain restrictions to allow for greater workforce agility- and thereby reducing the cost burden on employers. Moreover, certain costs for the EU will not be assigned freeing up possibilities for the UK government to reduce taxes and stimulate the export climate.

- The UK will remain to be competitive compared to other third countries due to the distance (shipping/lead times), manufacturing quality, and leverage of possible existing European references.

- This scenario makes establishing relationships and new customers now more important to stay ahead of third countries and establish strong relationships. It is good timing to take advantage of the Brexit negotiations and potential extension.

- Increase turnover to increase margin and offset exporting costs (expected 4.9% increase of costs) raised by WTO deal. Start now to grow your sales which will be profitable and allows you flexibility in your pricing by that time to out-compete, competitors. The European market size and future growth trends cannot be denied.

- The medical device industry will be least impacted by an export with a no-deal outcome.

- The USA has a WTO agreement with tariffs and remains to be Europe’s largest importer for decades. This proves the WTO deal will have an impact on competing with European businesses, while still allowing significant growth opportunities for value-added premium goods.

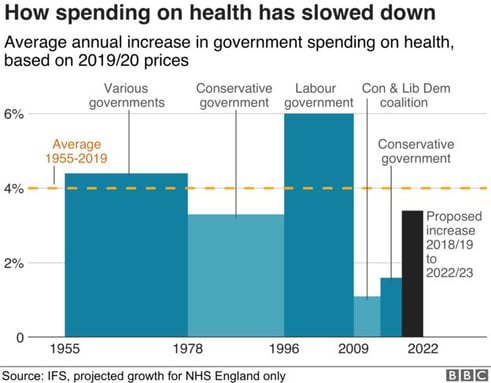

3. NHS budget continues to be under pressure

The average NHS spending has been just over 4% and dropped in recent years to 1%. The plan is to increase the budget in a five-year funding plan until 2023 to 3.4% but overall the trend shows a decreasing line, especially in the short term due to significant investments such as the Nightingale projects and many more that have been caused by the Covid-19 pandemic.

When comparing the UK to other EU countries, the UK spends a lower proportion on health than comparable EU countries as a % of GDP. The UK spends about 10% of the GDP similar to the average EU country. The UK has fewer beds, doctors, and nurses per patient than the big spenders such as Germany, France, and Sweden.

The satisfaction level of the majority of the public is decreasing caused of waiting times and a lack of staff people.

(Source: https://www.bbc.com/news/health-50290033)

As the NHS and its budget continue to be under pressure affecting the demand and growth of medical device manufacturers, the need to diversify, spread risk, and look for new growth opportunities for UK-based medical device manufacturers has been more important than ever.

4: The Covid-19 pandemic is slowing down

There will be an increased need for care and medical devices post-corona and some countries have announced an expansion of their ICUs. For example, the Netherlands will be expanding its ICUs with 600 beds.

Many companies and possibly your competitors are waiting until the dust settles but they will take the risk of missing the boat. We have experienced distributors who are rethinking their market approach and re-considering their product line. Many have time to evaluate at this point and it is a good moment to start engaging and building up relationships to take advantage of their time and stay ahead of the competition.

Travel restrictions may seem locked temporarily, however, the upcoming time can be leveraged by focusing on building relationships, setting up and training channel partners, preparing your marketing, and getting your organization ready to launch.

5: The new medical device regulations require you to act now on your European channel partners

The EU parliament has agreed to postpone the MDR regulations by one year to 26 May 2021. From this moment onward all medical devices placed on the EU market have to comply with the new Medical Device Regulation directives.

After Brexit, the UK will be considered a third country and will have to comply with these regulations. This will have an impact and requires a revision of the economic operators (importer/distributors) in Europe as UK companies are no longer able without a European entity to place goods directly without an importer. There will be a new set of responsibilities and liabilities for all parties including the manufacturer.

We therefore highly recommend starting revising your European economic operators to make sure if they can comply with these regulations and that you have an MDR-compliant agreement in place to avoid and prevent risks and liabilities. These changes make it even more important to have the right channel partners (importers/distributors) selected and engaged.

Need help with MDR compliance? EuroDev can assist in revising and conducting due diligence with your current channel partners to make sure they comply, add and develop new importers/distributors if needed, or help with the agreement to make sure all parties are compliant. We can also refer you to our partners who are able to answer your questions..png?width=1584&name=uk-blog_47227693%20(1).png)

How business expansion services can help you become successful in Europe

Especially in times of uncertainty, it is important for companies to stay agile. With both scenarios, it makes it challenging and costly for UK companies to hire a European workforce or choose a commission structure where there is a lack of focus and dedication. An alternative is to set up a European entity further increasing costs and liabilities.

Services:

Sales Outsourcing: - A localized dedicated approach acting and operating under your behalf with a network and understanding of the market, allowing companies to test and grow markets organically in a low-risk and especially flexible manner that can for example increase or reduce capacity and can be flexible with your market and audience approach. In-house, we speak 21 languages and have a PAN European approach. Together with our infrastructure, we can help you get more and better sales results.

HRO services - When you do have employees in Europe or considering hiring someone in Europe, a PEO service can help you prevent setting up your own European entity and make sure you comply with local regulations.

Digital marketing services - A key factor that will have an impact on your success is making sure your online presence is strong in local markets. 80% of buyers do their research online in their own language. Online and offline development go hand in hand. When you do make a choice to expand in local markets, having a digital marketing plan will be evident.

Moreover, research shows only 25% of companies exporting to Europe succeed. The most frequently made mistakes are, not understanding culture/language differences, poor product localization, misunderstanding the market dynamics, bad hiring decisions, and insufficient marketing power and focus (Prather and Gosh, 2015).

It can be very costly to make mistakes and it will be difficult to fix them. Therefore, partnering with an experienced company will help you make the right decisions, and save time and money.

More information

For more information, read about our Sales Outsourcing program.

Please feel free to schedule an introductory call with Emre Aykac to discuss your opportunities and how we can assist.

Our track record

With our 24 years of experience, EuroDev has assisted over 300 North American and UK manufacturers with their European expansion. Our unique approach, infrastructure, 21 language capabilities, and Rolodex allow all the benefits of a European office and team without the costs and risks of having your own physical presence or hiring your own employees.

Benefits of working with EuroDev:

- All the benefits of having your European office without the cost and liabilities

- Virtual office and dedicated, exclusive multilingual sales team acting and operating on your behalf

- 24 years of experience in setting up distribution and OEM partnerships across Europe

- Rolodex and network that will help increase your speed to market time

- PAN European approach - 21 language capabilities in-house and experience in all European countries

- You stay in control and grow organically

- Low-risk, flexible and cost-effective

- One-stop shop business development services (HRO, M&A, Digital marketing)

Category

Related articles

-

MEDICA: Expanding Horizons to Europe

7 November 2023Explore the opportunities for expanding your healthcare business into Europe with the Medica trade...

Read more -

Unleashing the Potential of Digital Health Market in Europe

26 June 2023Digital Health Market in Europe is growing each year, which opens more opportunities for foreign...

Read more -

Quality Management System (QMS) and ISO 13485

15 May 2023This blog is about quality management systems (ISO 13485), one of the most important requirements...

Read more